fsa health care eligible expenses

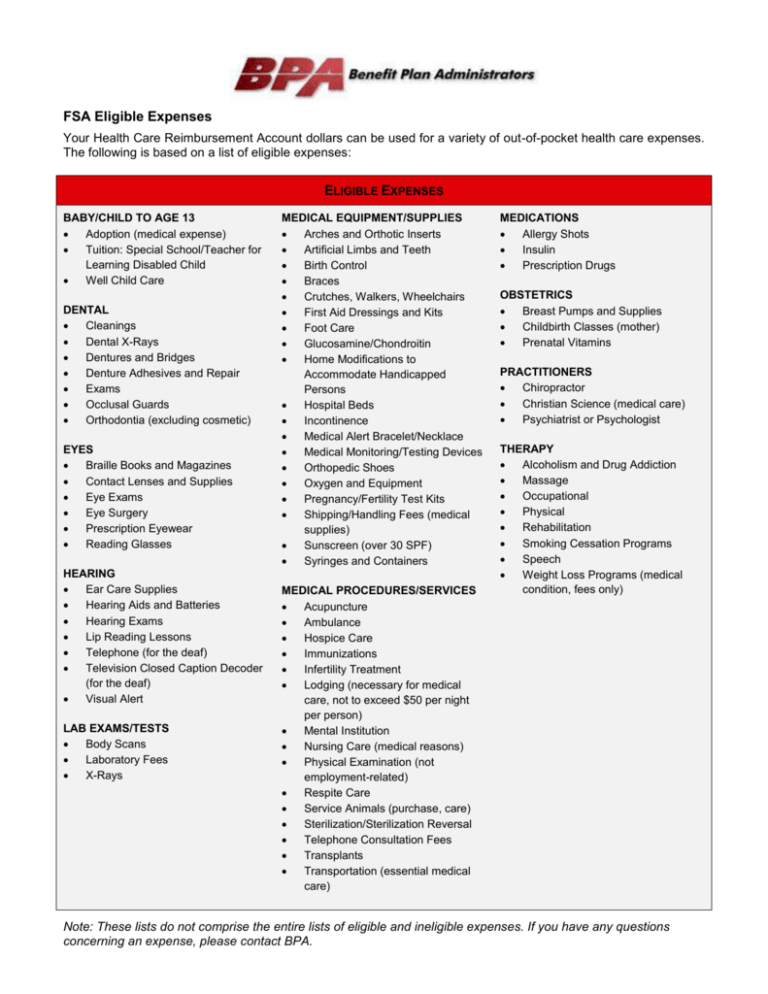

The detailed information for Health Care Flexible Spending Account Eligible Expenses is provided. Below are examples of eligible expenses for the following accounts.

Health Care Fsa Eligible Expenses University Human Resources The University Of Iowa

Massage Therapy is eligible for reimbursement with a Letter of Medical Necessity LMN with flexible spending accounts FSA health savings accounts.

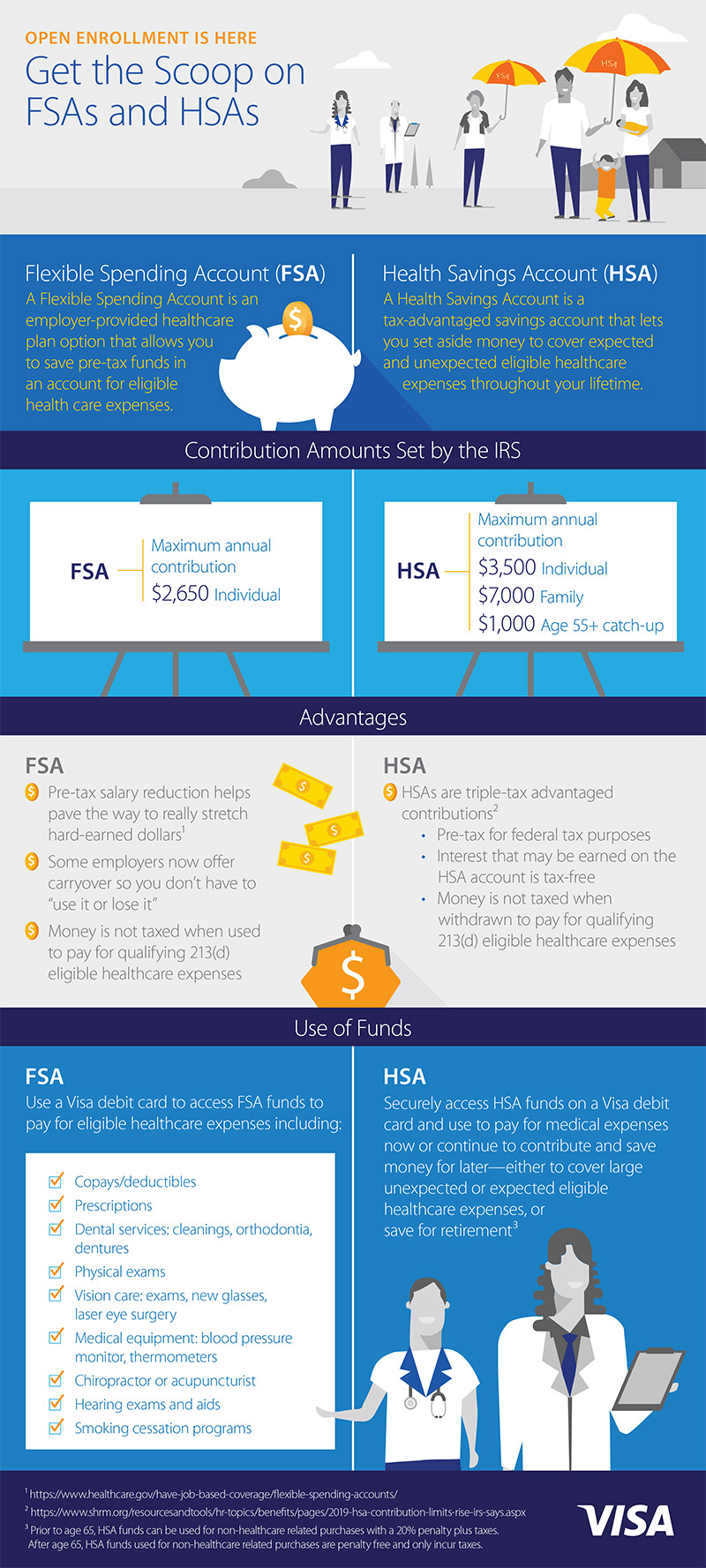

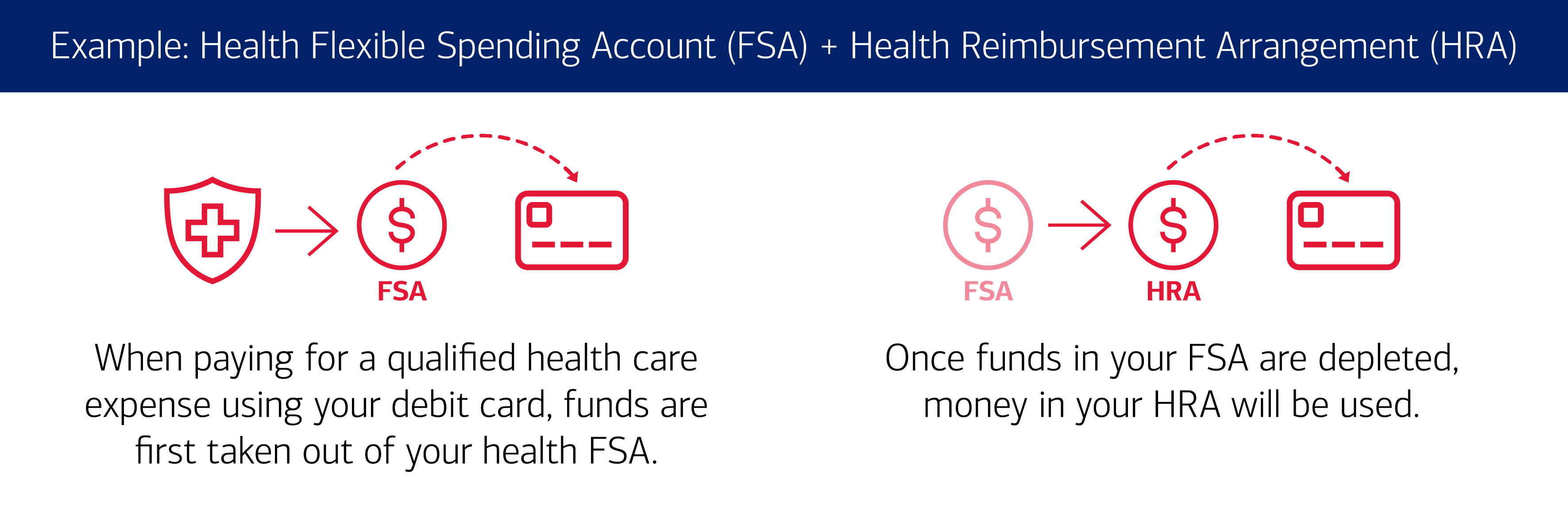

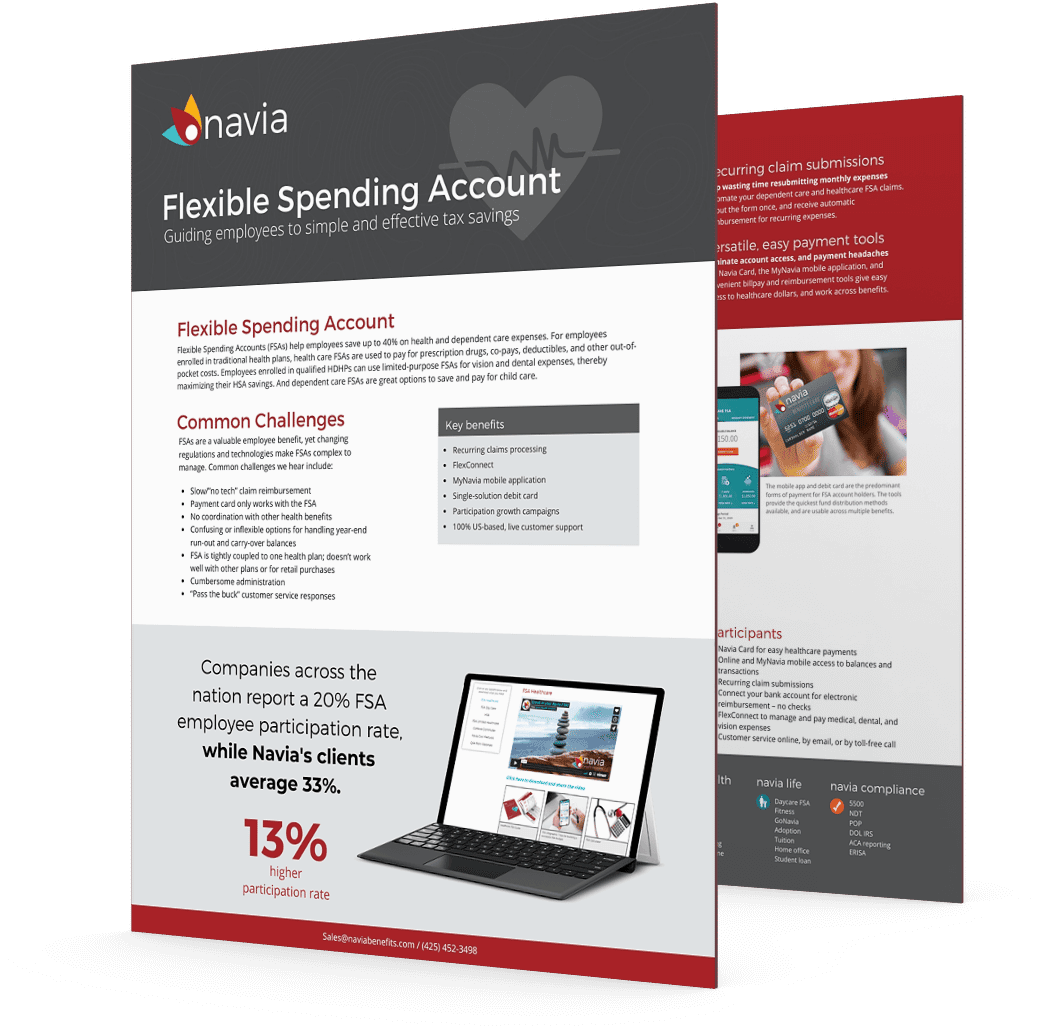

. FSAs allow you to contribute pre-tax dollars for qualified. The key to making the most of your Health Care Spending Account is understanding the expenses that qualify for reimbursement. Health Care Flexible Spending Accounts FSAs let employees set aside money from their paycheck before taxes to use for certain eligible expenses.

An HSA will reimburse you for long-term care insurance premiums up to limits established each year. The IRS determines which expenses can be reimbursed by an. February marks National Childrens Dental Health Month and you may be wondering if your dental care is an FSA-eligible expense.

There is one way all active federal employees can save on some out-of-pocket costs. Health care spending accounts HSA are a type of account that can be used to pay for medical expenses. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer.

What Are My FSA Eligible Expenses. Medicare and other health care coverage are eligible if you are 65 or older. Open enrollment for the Health Flexible Spending Account Plan FSA 2017 benefit year runs from October 1 through October 31 2016.

Help users access the login page while offering essential notes during the login process. A Flexible Spending Account FSA is a great way for individuals to pay for eligible expenses using money you set aside before taxes via a payroll deduction with your employer. A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care-related out-of-pocket.

HSA Health FSA and HRA Eligible Expenses ConnectYourCare 2021-12-22T101136-0500 There are thousands of eligible expenses for tax-free purchase with a. Transportation parking and related travel expenses essential to receive eligible care Transportation parking and related travel expenses for non-eligible expenses. Many people are wondering if a stethoscope is covered by their.

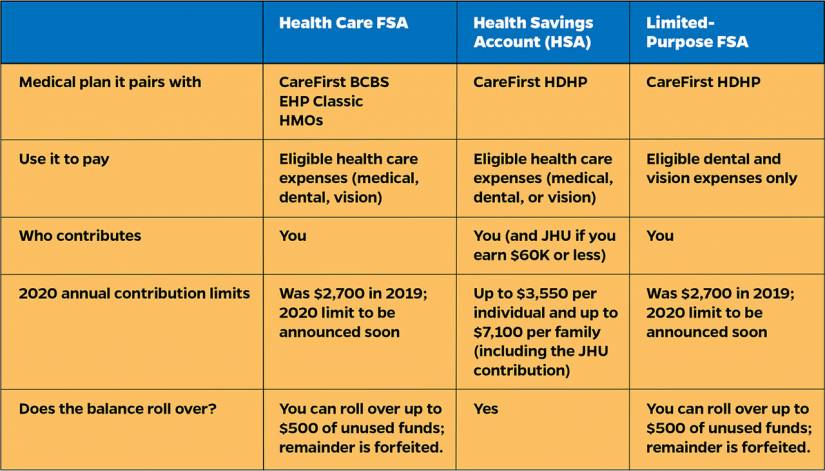

Flexible Spending Account Limited Purpose Flexible Spending Account and Dependent Care Account. Dental procedures are covered under your FSA. Health Care FSA Eligible Expenses.

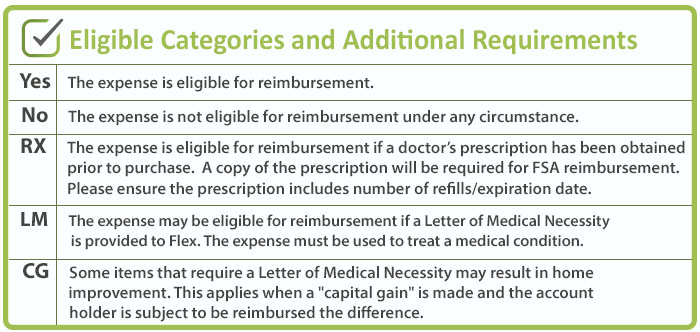

The IRS determines which expenses are eligible for reimbursement. The expenses associated with the adoption of a child are not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement. Employers end up saving on taxes.

When you enroll in the Health FSA you. Maximize the Value of Your Reimbursement Account - Your Health Care Flexible Spending Account FSA dollars can be used for a variety of out-of-pocket health care expenses. If youre married your spouse can put up to 2850 in an FSA with their employer too.

Eligible expenses include health plan co-payments dental work and. The Internal Revenue Service IRS determines what are considered eligible expenses for all Flexible Spending Accounts. You can use your FSA funds to pay for a variety of expenses for you your spouse and your dependents.

A listing of eligible expenses can be found on the FSAFEDS.

Fsa Rules 3 Tips For Easily Complying With The Irs Connectyourcare

What Is An Fsa Definition Eligible Expenses More

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator

Your Handy List Of Fsa Eligible Expenses Employers Resource

Fsa Eligible Expenses Fill Online Printable Fillable Blank Pdffiller

Hsa And Fsa University Of Colorado

Fsa Eligible Expenses Your Health Care Reimbursement Account

Using Your Health And Benefit Visa Debit Card

List Of Hsa Health Fsa And Hra Eligible Expenses

Federal Employees Not Eligible To Contribute To An Hsa Should Instead Contribute To An Hcfsa

Navia Benefits Health Care Fsa

Navia Benefits Health Care Fsa

Fsa Flexible Spending Account Benefits Wex Inc

Flexible Spending Accounts Ensign Benefits

Hsa And Fsa Accounts What You Need To Know Readers Com

What To Know About Spending Accounts For 2020 Hub

Health Care Fsa Eligible Expenses University Human Resources The University Of Iowa